tax sheltered annuity calculator

Fidelity does not provide legal or tax advice. YTM vs TEY - This bar chart displays a comparison between the yield to maturity and the tax equivalent yield.

The Best Annuity Calculator 17 Retirement Planning Tools

Compare 143 fixed annuities 2 to 10 years in length to achieve the highest fixed annuity rates in the United States.

. Qualified moneyExamples would be the money you have in an IRA 401k or tax-sheltered annuity 403b. If you have difficulty viewing the input calculation screen press and hold the Ctrl key then tap the. So youre not paying taxes on each years earnings.

A 403b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers. Before investing consider the investment objectives risks charges and expenses of the fund or annuity and its investment options. A tax-sheltered annuity plan 403b plan or.

A fixed annuity is a tax-deferred high yield savings account for retirement competing with the best CD rates today. In addition to potential surrender fees the IRS also charges a 10 early withdrawal penalty tax if the annuity-holder is under the age of 59 ½. If you work for a public school or certain tax-exempt organizations you may be eligible to participate in a 403b retirement plan offered by your employer.

The benefit of accumulating money in a qualified plan is that the money grows tax-deferred. The CSRS FERS and TSP are considered qualified retirement plans. This may be useful if you are considering changing your federal or state tax withholding deferred compensation or tax-sheltered annuity amounts.

Tax-sheltered annuity plans 403b plans. An eligible state or local government section 457 deferred compensation plan. If your income tax bracket is higher now than it is in retirement you could be losing a sizable chunk of the lump sum in taxes.

I would recommend using our free quote calculator to run a quote comparison for yourself. It mirrors the tax equivalent yield column in the data table. Examples of annuities are regular deposits to a savings account monthly home mortgage payments monthly insurance payments and pension payments.

Its similar to a 401k plan. To enable State employees and teachers to participate in voluntary tax sheltered income deferral tax deferred annuity and profit sharing and salary reduction savings plans that offer members tax advantages as provided in the Internal Revenue Code. Tax Equivalent Yield - The tax equivalent yield line chart displays the TEY over time.

A defined contribution plan is an employer-sponsored retirement plan funded by money from employers and employees. The money you save for retirement in a defined contribution plan is invested in. The typical timeframe for receiving cash from an annuity is four weeks.

Fixed annuities are utilized like long-term savings accounts. A 403b retirement plan is a thrift savings plan or tax-sheltered annuity plan offered by some charities and most public school districts. Although this publication covers the treatment of benefits under 403b plans and discusses in-plan Roth rollovers from 403b plans to.

It is calculated off of the municipal bonds yield that is calculated each year. Contact Fidelity for a prospectus or if available a summary prospectus containing this information. Distributions eligible for rollover treatment.

Investing involves risk including risk of loss. Annuities can be classified by the frequency of payment dates. Its similar to a 401k plan.

To help cover the tax liability a lump-sum payout from a pension that is not directly rolled over is subject to a 20 mandatory tax withholding. A 403b plan functions similarly to a 401k plan by featuring tax-deferred growth. An annuity is a series of payments made at equal intervals.

Compare 143 fixed annuity rates. This calculator is designed for use while planning an annuitys accumulation phase and displays growth based on regular deposits similar to a CD rate. The payments deposits may be made weekly monthly quarterly yearly or at any other regular.

The time it takes to receive money from an annuity often depends on the company you are dealing with.

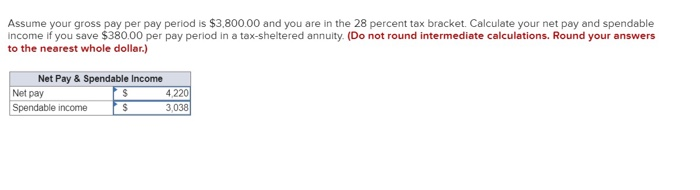

Solved Assume Your Gross Pay Per Pay Period Is 3 800 00 And Chegg Com

What You Should Know About Tax Sheltered Annuities The Motley Fool

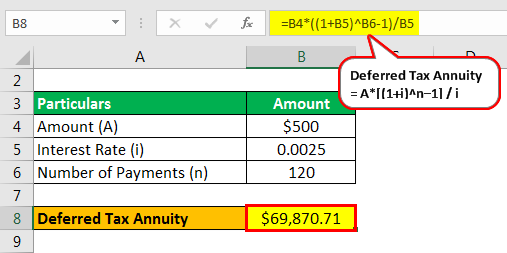

Tax Deferred Annuity Definition Formula Examples With Calculations

Tax Sheltered Annuity Plan Lovetoknow

Tax Deferred Annuity Definition Formula Examples With Calculations

Annuity Payout Options India Dictionary

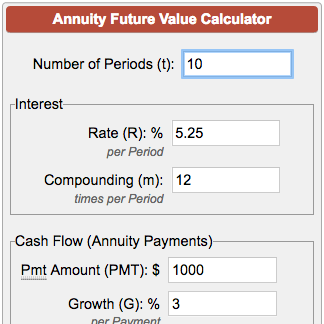

Annuity Investment Calculator Investment Annuity Calculator

The Best Annuity Calculator 17 Retirement Planning Tools

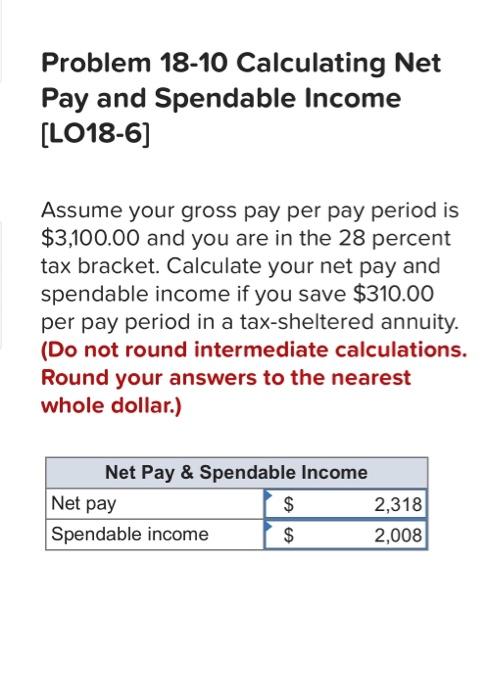

Solved Problem 18 10 Calculating Net Pay And Spendable Chegg Com

The Best Annuity Calculator 17 Retirement Planning Tools

Withdrawing Money From An Annuity How To Avoid Penalties

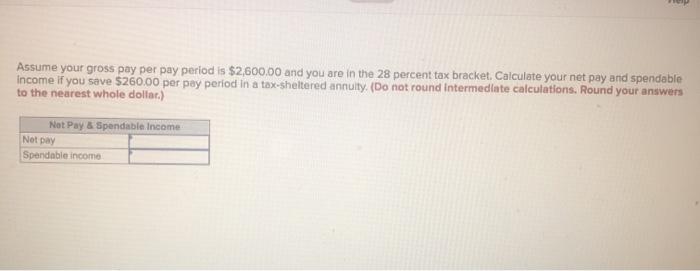

Solved Assume Your Gross Pay Per Pay Period Is 2 600 00 And Chegg Com

Obamacare Investment Tax Problem For High Income Earners

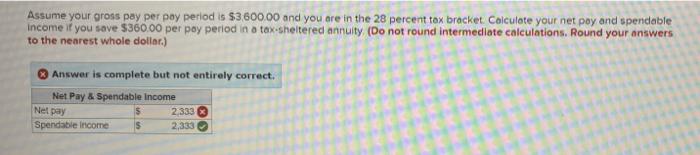

Solved Assume Your Gross Pay Per Pay Period Is 3 600 00 And Chegg Com

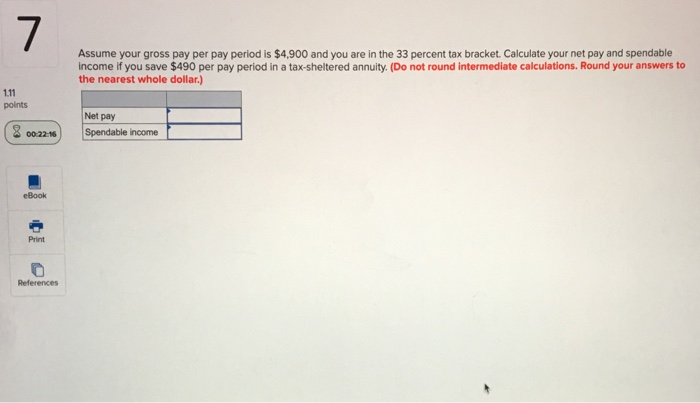

Solved Assume Your Gross Pay Per Pay Period Is 4 900 And Chegg Com

Tax Deferred Annuity Definition Formula Examples With Calculations